You can find total earnings, which is the same as net income, and the number of outstanding shares on a company’s income statement. It shows how much profit can be generated per share of stock and is calculated by dividing earnings by outstanding shares. The Basic EPS is a profitability ratio used to measure the residual net income allocatable to common shareholders on a per-share basis. Such companies generally compute both basic and diluted earnings per share to ensure that investors have all the information they need about the company’s profits. As the name suggests, convertible preferred shares can be transformed into common shares if the shareholder desires.

What Is A Good Earnings Per Share?

Get instant access to video lessons taught by experienced investment bankers. Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts. This is commonly used by investors because it gives a more accurate picture of a company’s true profitability.

Use by Investors and Analysts

In the following sections, we will look at the sorts of stock and earnings per share companies offer. This means that as a shareholder, you are entitled to part of the company’s profits through dividends and increased value if the company’s overall worth rises. Changes to accounting policy for reporting earnings can also change EPS. EPS also does not take into account the price of the share, so it has little to say about whether a company’s stock is over or undervalued. An important aspect of EPS that is often ignored is the capital that is required to generate the earnings (net income) in the calculation.

Basic Earnings Per Share Example

For this metric, the higher the figure the higher the profitability for shareholders is, at least in the short term. Simply put, Basic EPS is the company’s net after-tax profits divided by the number of shares outstanding. The determination of a “good” basic EPS number depends on various factors, including the industry, company size, growth prospects, and investor expectations.

What is your current financial priority?

Therefore, the potentially dilutive securities are assumed to be exercised, irrespective of whether they are “in-the-money” or “out-of-the-money”. Ultimately, the company’s allocation of its net earnings is a discretionary decision determined by management and the board of directors, with the goal of maximizing shareholder value. Since EPS is just one possible metric to use to examine companies’ financial prospects, it’s essential to use it in conjunction with other performance measures before making any investment decisions.

Increasing basic EPS, however, does not mean the company is generating greater earnings on a gross basis. Companies can repurchase shares, decreasing their share count as a result and spread net income less preferred dividends over fewer common shares. Basic EPS could increase even if absolute earnings decrease with a falling common share count. Basic earnings per share is a rough measurement of the amount of a company’s profit that can be allocated to one share of its common stock. Businesses with simple capital structures, where only common stock has been issued, need only release this ratio to reveal their profitability.

- This does mean that basic share count will change from period to period.

- First, the exercise price of the options or warrants may be above the trading price.

- 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements.

- In comparison, after another year of strong performance, basic EPS is $2.42 as a result of the growth of $25mm in net income and a reduction of 10mm shares.

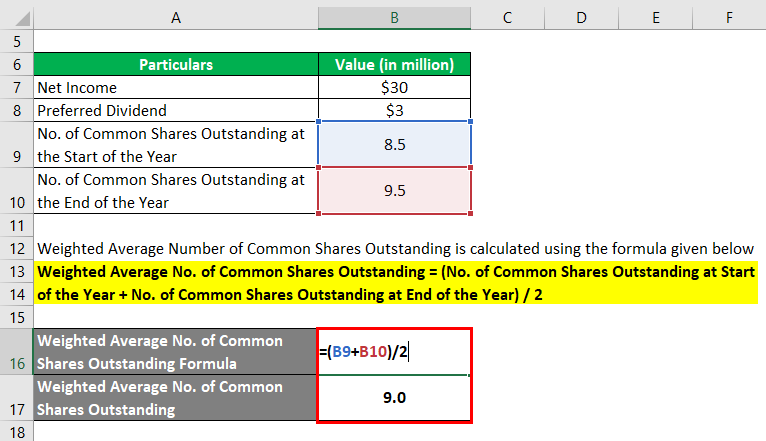

A higher earning per share indicates that a company has better profitability. On the other hand, the number of shares tends to change throughout integrate pdffiller with xero the time period. That is why the analyst has to calculate the weighted average of common shares outstanding during the period.

A more mature company could simply have a bad year operationally (as many companies did during the novel coronavirus pandemic). An accounting charge related to a past acquisition (often referred to as a ‘writedown’) could erase profits and lead to a reported net loss. A large, one-time, litigation settlement can lead to a short-term spike in expenses. If it loses $10 million with 10 million shares outstanding, basic loss per share is $1.00 even. But the outstanding options — whether in the money or not — do not affect diluted share count. Again, they are anti-dilutive; if they were added to the diluted share count, loss per share would improve slightly, to $0.95.

A shareholder, as previously defined, has a stake in the company and owns shares. Investing in the stock market is a lucrative way of life that can enable people who are not ready to start their own businesses to profit from existing firms. Rolling EPS gives an annual earnings per share (EPS) estimate by combining EPS from the past two quarters with estimated EPS from the next two quarters. PwC refers to the US member firm or one of its subsidiaries or affiliates, and may sometimes refer to the PwC network. This content is for general information purposes only, and should not be used as a substitute for consultation with professional advisors. My Accounting Course is a world-class educational resource developed by experts to simplify accounting, finance, & investment analysis topics, so students and professionals can learn and propel their careers.

A metric that can be used to identify more efficient companies is the return on equity (ROE). To get a more accurate projection of earnings on a per share basis, both Net Income and Common Stock are often adjusted by investors. But in actuality, stock splits and reverse splits can still affect a company’s share price, which depends on the market’s perception of the decision.